-

Accounting Dashboard

-

General Accounting Set up

-

Analytic Accounts

-

Chart of Accounts

-

Day to Day Transactions

-

Sales

-

Banks & Bank Reconciliations

-

Fixed Assets

-

Year/Month End

-

Reports

-

Purchase Order approval

-

POS

-

POS Reconciliations

-

Purchasing

-

Non stock purchasing

-

Expense Module

-

Shopify Sales

-

Invoice Reminders

-

Customer Statements

-

Tax

-

Supplier Batch Payment

-

Product Categories

-

Inventory Valuation Journals

-

Analytic Accounts

-

Rebates

How to reconcile the trade loan settlement

In order to pay/settle the Trade loan,

1. Go to the " Accounting Dashboard" select the relevant bank and Click "Reconcile"

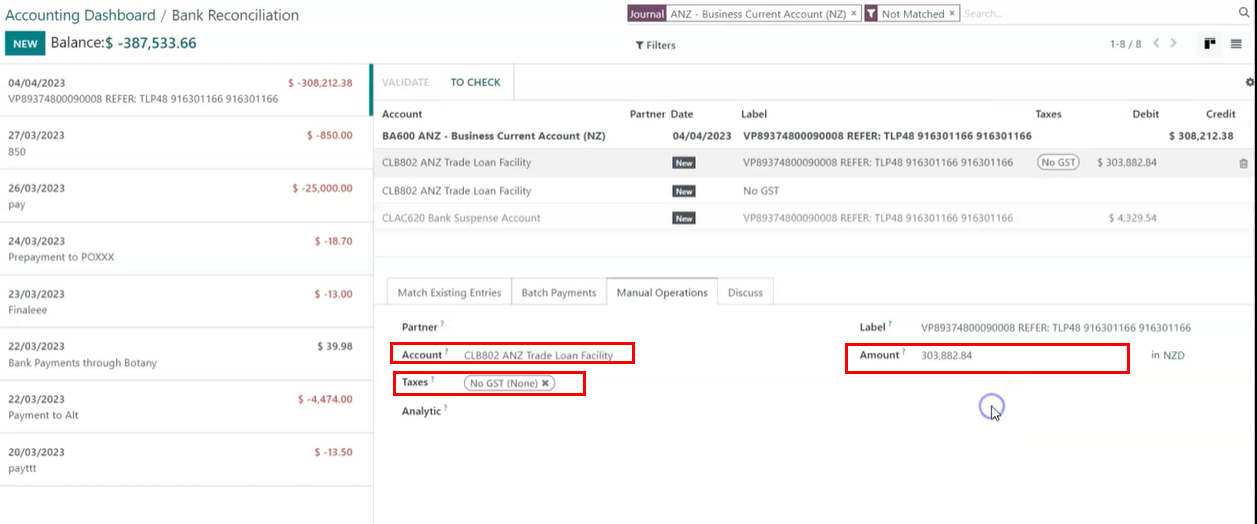

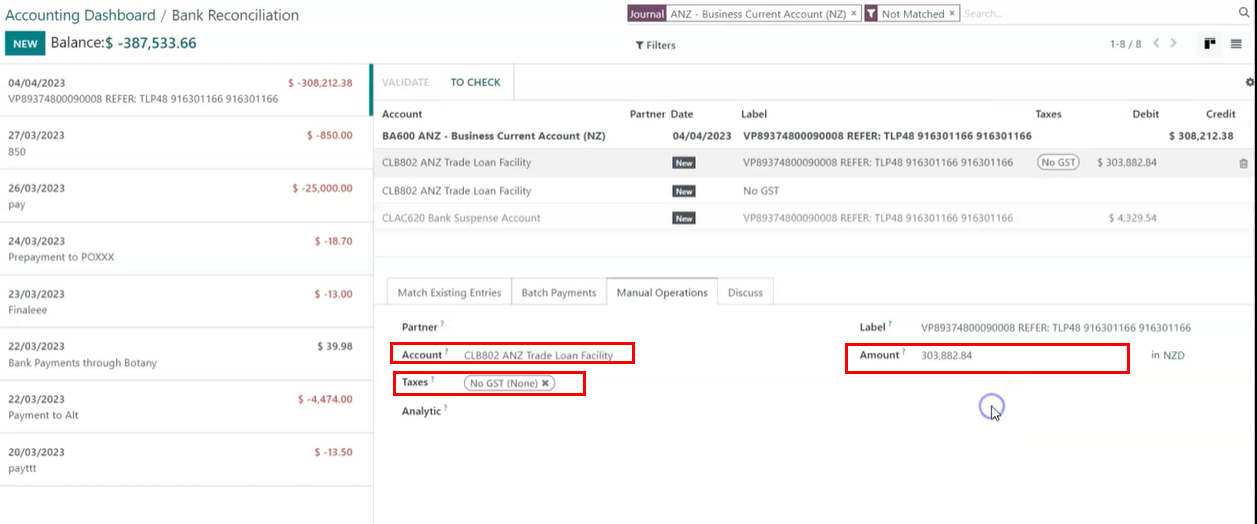

2. Select the bank feed that you have paid for Trade loan account, Then In the " Manual Operations" tab select the "Trade loan Account", and select the Taxes as No GST (None) and input the Trade loan amount without the interest. ($ 303,882.84)

3. Recognize the balance amount $4,329.54 to Interest account. Click the line showing as Bank suspense account and under the Manual operations tab select the interest expense account, select the taxes as No GST ( None) and Click on VALIDATE.

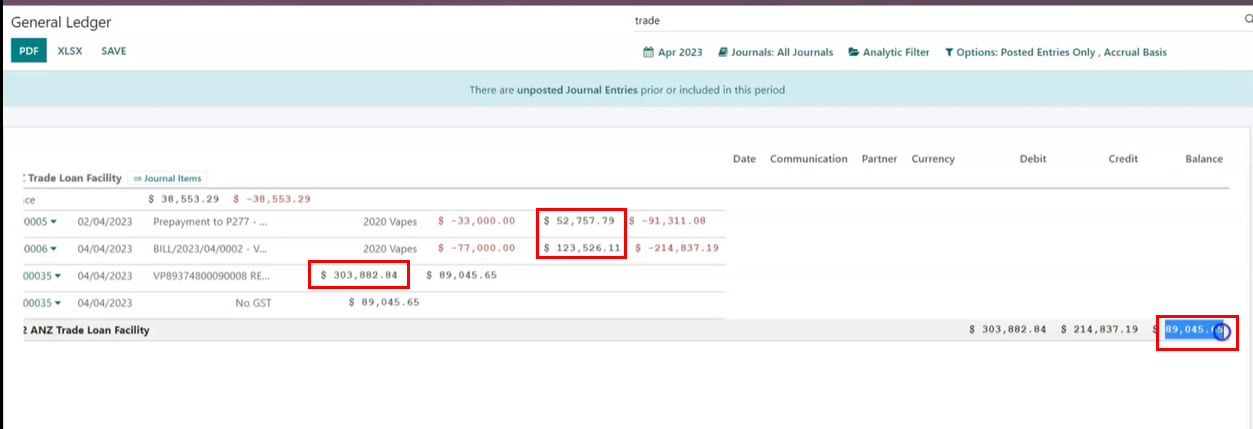

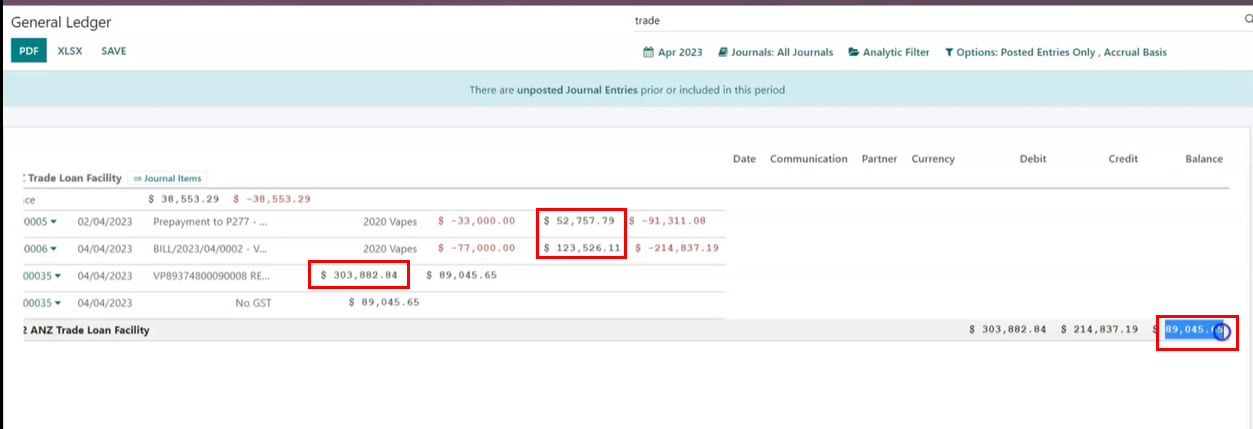

4. Once you have validated, to check the transactions and balances in Trade Loan account, Click the " Reporting" and select the "General ledger"

5. Search for " Trade loan Facility" account , Here you can see the bill payments ($ 52,757.79 & $ 123,526.11) in the credit side and the amount ($303,882.84) we paid from our bank account to Trade loan account can be seen in the debit side. Also you can see the balance of Trade loan account in the bottom ($ 89,045.65)

1. Go to the " Accounting Dashboard" select the relevant bank and Click "Reconcile"

2. Select the bank feed that you have paid for Trade loan account, Then In the " Manual Operations" tab select the "Trade loan Account", and select the Taxes as No GST (None) and input the Trade loan amount without the interest. ($ 303,882.84)

3. Recognize the balance amount $4,329.54 to Interest account. Click the line showing as Bank suspense account and under the Manual operations tab select the interest expense account, select the taxes as No GST ( None) and Click on VALIDATE.

4. Once you have validated, to check the transactions and balances in Trade Loan account, Click the " Reporting" and select the "General ledger"

5. Search for " Trade loan Facility" account , Here you can see the bill payments ($ 52,757.79 & $ 123,526.11) in the credit side and the amount ($303,882.84) we paid from our bank account to Trade loan account can be seen in the debit side. Also you can see the balance of Trade loan account in the bottom ($ 89,045.65)

Rating

0

0

| Views | |

|---|---|

| 252 | Total Views |

| 1 | Members Views |

| 251 | Public Views |