-

Accounting Dashboard

-

General Accounting Set up

-

Analytic Accounts

-

Chart of Accounts

-

Day to Day Transactions

-

Sales

-

Banks & Bank Reconciliations

-

Fixed Assets

-

Year/Month End

-

Reports

-

Purchase Order approval

-

POS

-

POS Reconciliations

-

Purchasing

-

Non stock purchasing

-

Expense Module

-

Shopify Sales

-

Invoice Reminders

-

Customer Statements

-

Tax

-

Supplier Batch Payment

-

Product Categories

-

Inventory Valuation Journals

-

Analytic Accounts

-

Rebates

How to create a Credit Note without a return

In order to create a credit note without a return,

We need to create a stand alone credit note without adding the product details for the particular vendor with the same amount and apply it to the original invoice.

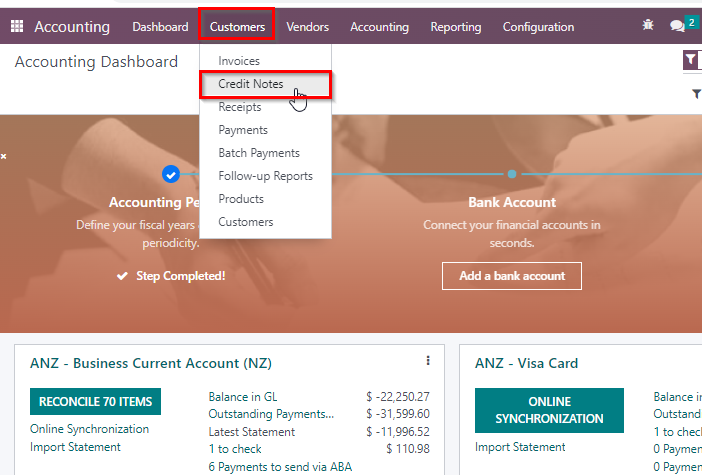

1. Go to the Accounting Dashboard> Customers> Credit Note.

2. Click New and Fill in the details:

i) Customer - Relevant customer whom your about to create the credit note

ii) Invoice Date - Credit note creation date

iii) Product - Do not select any product as we are not receiving the product

iv) Label - You can provide any relevant detail

v) Account - This should be sales account

Vi) Quantity & Price - These can be picked from the original invoice

vii) Taxes- Same tax used in original invoice should be used

3. Once done, you can click on CONFIRM.

Now you have created a stand alone credit note.

4. Once you go back to the relevant invoice for which you have created the credit note, there at the bottom you will see an outstanding payment. (This is the credit note that you have created above).

5. Now you can click on Add and apply the stand alone credit note to the original invoice (INV/2023/000157).

6. Once you have applied the payment invoice will be updated with the PAID tag and click on Journal items tab to see the journal entries.

7. Here you can see the COGS account haven't been affected as this is a credit note created without the return.

| Views | |

|---|---|

| 88 | Total Views |

| 1 | Members Views |

| 87 | Public Views |